An Independent QA Layer for Your Existing Operations

MyCustomsInfo® is designed to support, not replace, your internal teams and customs brokers. We provide the high-scale oversight that is impossible to achieve manually.

You Stay in Control

Your team and brokers remain responsible for all official filings. We provide the evidence-based insights you need to manage them more effectively.

Defensible Findings

Every recovery opportunity or risk alert comes with full regulatory citations, giving you the confidence to defend positions to customs authorities.

Scale Without Headcount

Audit millions of lines of data across multiple jurisdictions without adding a single person to your team.

Proven Results You Can Trust

Numbers that demonstrate our commitment to excellence and client success

Real outcomes for importers, exporters and brokers across UK, EU, North America and APAC.

Enterprise Trust & Security

Built with the highest standards of security, compliance, and professional expertise

Enterprise-Grade Security

- End-to-end encryption

- ISO 27001 & ISO 28000 compliant

- GDPR compliant data handling

- Multi-region data centers

- Complete audit trails

Built by Customs Experts

- Licensed customs brokers on staff

- Former customs officials

- Import/export specialists

- Data scientists & engineers

- 20+ years combined experience

Transparent Methodology

- AI first-pass analysis

- Expert validation process

- Documented evidence for every finding

- Regulatory citations included

- Continuous learning system

Your Data Security is Our Priority

We understand that customs data is sensitive business information. That's why we've implemented enterprise-grade security measures and maintain strict compliance with international data protection standards.

Secure & Compliant

Enterprise-grade security

The Customs Compliance Challenge

Every customs declaration carries risk. Misclassified goods, incorrect valuations, and incomplete documentation can trigger audits, penalties, and shipment delays. Yet most businesses don't have the resources to review every entry—or train every team member on evolving regulations.

MyCustomsInfo® is the compliance safety net that catches errors before customs authorities do.

The cost of compliance errors extends far beyond penalties:

Cash Flow Impact

Tie up working capital in disputed penalties and delayed shipments

Operational Disruption

Diverted resources from core business to compliance firefighting

Reputation Risk

Customer delays and regulatory attention damage business relationships

Comprehensive Customs Compliance Across All Your Markets

Six integrated services delivering high-scale data validation, with every finding validated by licensed experts across UK, EU, North America, and Asia-Pacific customs authorities. Direct and defensible evidence packs for every recommendation.

Duty Recovery & Compliance Audit

High-scale data validation to identify recovery opportunities and underpayment risks across all jurisdictions. Every finding includes full regulatory citations and defensible justification—ready for submission to customs authorities.

- Gain-share recovery model available

- Multi-authority coverage (UK, EU, US, Canada, APAC)

- Licensed broker validation with regulatory citations

HS Code Classification

Defensible justification to protect against misclassification penalties. AI-suggested tariff codes validated by experts using General Interpretive Rules (GIRs), with documentation you can defend during customs audits.

- Defensible justification documentation

- General Interpretive Rules (GIRs) application

- Penalty protection for misclassification

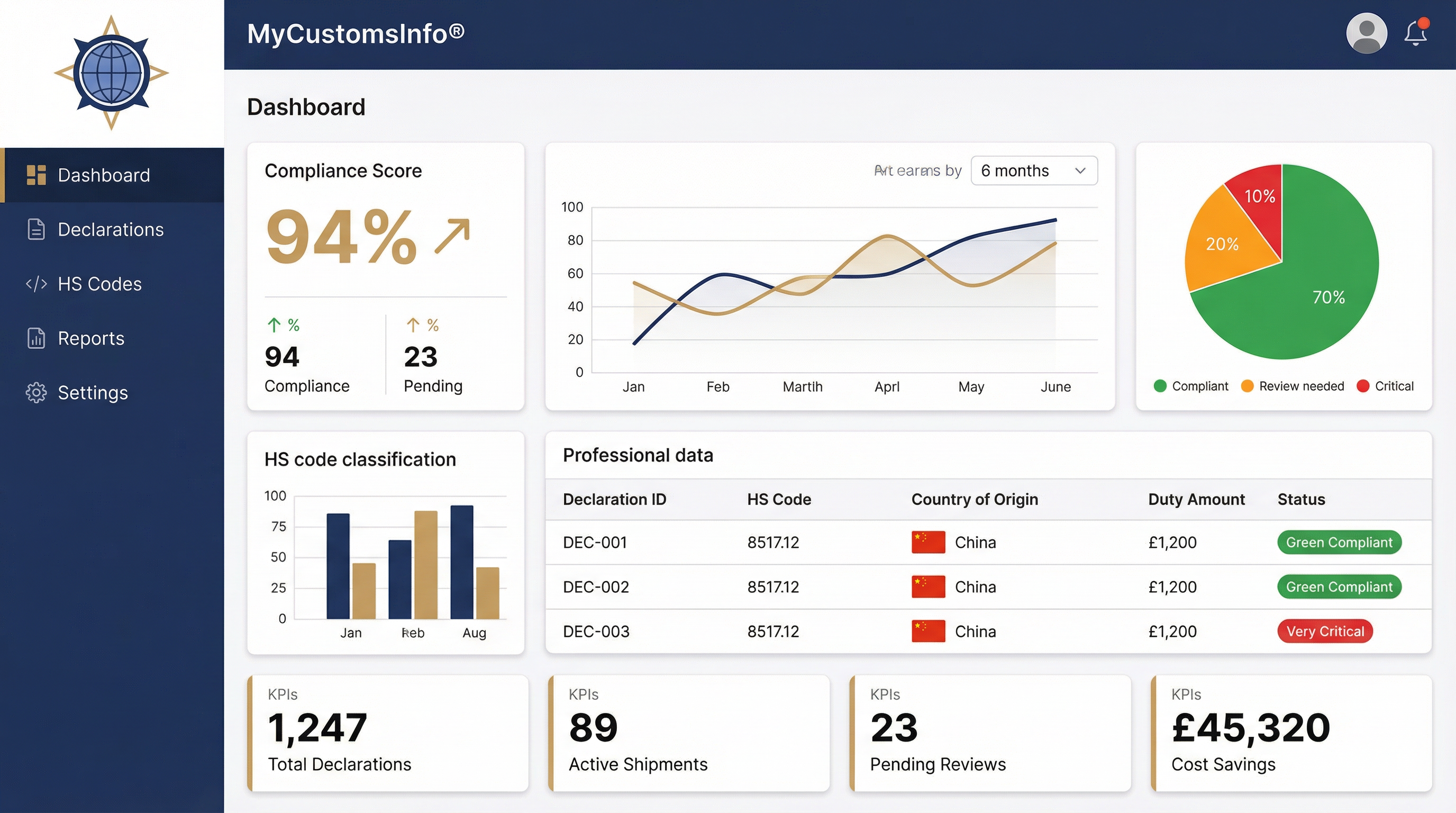

Compliance Tracking & Monitoring

Real‑time dashboards track your customs footprint, duty under management, risk indicators and customs compliance metrics including AEO readiness across up to three years of data. Filter by broker, location, commodity, origin, CPC and more.

- Real‑time compliance dashboards

- Duty under management tracking

- Customs compliance metrics including AEO readiness

Data Storage & Indexing

A secure, searchable archive for customs declarations, customs authority reports and supporting documents, with retention up to 7 years (84 months where required) and fast retrieval for customs audits, re‑submissions and internal investigations.

- Secure cloud storage with encryption

- Advanced search and filtering

- 7‑year retention (84 months)

Training via IOE&IT Partnership

Reduce future liability by closing skills gaps identified in your audit. Professional qualifications from the UK's Chartered Institute for Export & International Trade—not generic courses, but targeted training based on YOUR specific compliance needs.

- Reduces future liability through skills development

- IOE&IT professional qualifications (not just certificates)

- Training tailored to YOUR audit findings

CBAM Reporting (Now Active)

Financial obligation readiness for the CBAM definitive regime, active since January 1, 2026. Apply our proven audit methodology to quarterly emissions reporting and ensure compliance with carbon border adjustment obligations.

- Active regime compliance (Jan 1, 2026)

- Quarterly emissions reporting

- Financial obligation calculations

Why Our Integrated Approach Works Better

Comprehensive Coverage

All compliance needs in one platform, no gaps between tools

Faster Resolution

Connected services accelerate problem identification and fixes

Continuous Improvement

Training insights prevent future errors, building long-term capability

Group‑wide view across customs regimes

If you operate in more than one customs regime, MyCustomsInfo® lets you:

- Combine customs data from multiple countries into a single platform

- Compare duty and risk across jurisdictions, entities, brokers and product lines

- Apply consistent internal controls to all your customs activity, while still respecting local rules

This removes the need to manage separate spreadsheets, reports and tools in each country.

Why Global Businesses Choose MyCustomsInfo®

We combine cutting-edge AI with licensed customs broker validation to deliver accurate, actionable compliance insights across all your markets.

Multi-Authority Compliance in One Platform

Seamlessly manage customs regulations across the UK, EU, North America, and Asia-Pacific. No more juggling multiple systems or consultants for different regions.

AI-Driven Accuracy, Human Expertise

Our intelligent platform performs first-pass analysis, rigorously validated by licensed customs brokers. Every finding includes regulatory citations you can trust.

Proactive Risk Mitigation & Cost Recovery

Identify and rectify duty over/under-payments before they become costly issues. Reduce audit exposure and recover funds you didn't know you were owed.

Targeted Training & CBAM Reporting

Empower your team with training needs identification tailored to your operations. Stay ahead of emerging requirements like CBAM with integrated reporting tools.

Backed by the IOE&IT

As the official partner of the Chartered Institute of Export & International Trade, we bring institutional credibility and expertise to every engagement.

How MyCustomsInfo® Works

From upload to audit‑ready results in as little as 48 hours

Connect Your Customs Data

Import customs declarations and related data from multiple authorities and brokers. The portal standardizes this data so you can see your global customs position in one place.

- Supports data from multiple customs authorities across the UK, EU, North America, and Asia-Pacific regions

- End‑to‑end encryption and role‑based access control

- Drag-and-drop upload or API integration

Declarations, invoices, certificates

Detect Duty Recovery And Compliance Issues

The portal uses AI pattern recognition and rules, validated by licensed customs experts, to identify opportunities and risks.

- Detect overpayments and underpayments across your declaration history

- Highlight duty recovery opportunities that can self-finance the project

- Flag patterns and risks that might trigger future audits

- Example: Detects inconsistent use of preference codes against supplier declarations and customs rulings, flagging transactions for expert review

AI + Expert validation in progress

Act, Document And Monitor

Get defensible evidence packs with full regulatory citations, store declarations for up to 7 years, and track compliance over time.

- Generate defensible evidence packs with full regulatory citations

- Store declarations and supporting documents in a searchable archive (up to 7 years)

- Track your compliance score and risk over time across all entities and brokers

Prioritized audit results

Your data is encrypted end-to-end, and every recommendation includes detailed regulatory citations and defensible evidence.

Frequently Asked Questions

Everything you need to know about MyCustomsInfo® and customs compliance

For full details, visit our FAQ centre

MyCustomsInfo® does not replace your customs brokers or freight forwarders. It acts as an independent quality assurance layer over all your brokers and internal teams, checking 100% of declarations for errors, missed savings and risk across all entities and routes.

Your brokers continue to file declarations and handle day to day processes. The platform gives you, as importer of record, complete visibility and control, plus evidence packs and recommendations that your brokers can use to correct past entries and improve future compliance.

Still have questions?

Our customs compliance experts are ready to help you understand how MyCustomsInfo® can protect your business.

Ready to Take Control of Your Global Customs Risk?

See MyCustomsInfo® in action with a 20-minute live demo, or request a complimentary duty assessment to see the platform's findings on your own data—no commitment required.

Prefer to talk first? Our customs experts are standing by.